The Clean Fuel Regulations are reshaping Canada’s energy landscape by accelerating clean fuel deployment and creating new revenue pathways, says 3Degrees

Strong early results from Canada’s Clean Fuel Regulations reveal a market quickly adapting and capitalizing on low-carbon opportunities. Photo: 3Degrees

The Clean Fuel Regulations are reshaping Canada’s energy landscape by accelerating clean fuel deployment and creating new revenue pathways, says 3Degrees

This article is Sponsor Content presented by 3Degrees and written by Scott Vazzana, senior development manager

The 2023 launch of Canada’s Clean Fuel Regulations (CFR) marked a milestone in the nation’s journey toward net-zero emissions.

The regulations set out to reduce the carbon intensity (CI) of transportation fuels produced and used in Canada, particularly gasoline and diesel, by 15 per cent below 2016 levels by 2030, while accelerating the growth of domestic clean fuel production, renewable natural gas (RNG), and electrification. If this reduction is met, Canada would slash upwards of 26 million tonnes of greenhouse gas (GHG) emissions annually.

Two years in, the CFR has already spurred innovation, driven investment in decarbonization technologies, and opened new revenue opportunities for clean fuel producers and electric mobility providers. While still in its early stages, the CFR’s expanding credit market signals strong confidence in Canada’s future as a low-carbon fuel economy.

Some key developments include a surge in demand for RNG, the increased presence of biofuels such as renewable diesel (RD), and the more widespread deployment of zero-emission vehicle (ZEV) charging infrastructure.

The regulation’s launch also stimulated significant investment, with announcements of new low-carbon fuel production facilities, such as Imperial Oil’s renewable diesel project in Alberta, directly attributable to the market signals sent by the CFR. Additionally, the CFR’s credit trading market has become increasingly active, with the number of transfers roughly doubling year-over-year since launch.

While an initial bank of credits was built up, increasingly stringent CI targets will create greater demand going forward and may continue to drive up prices. With two compliance periods under our belt, there is significant data and developments to review for this evolving market.

In this article, we’ll examine how this credit-based system creates a powerful economic incentive for innovation and investment in clean technologies across the country.

Market-based approach to cutting carbon

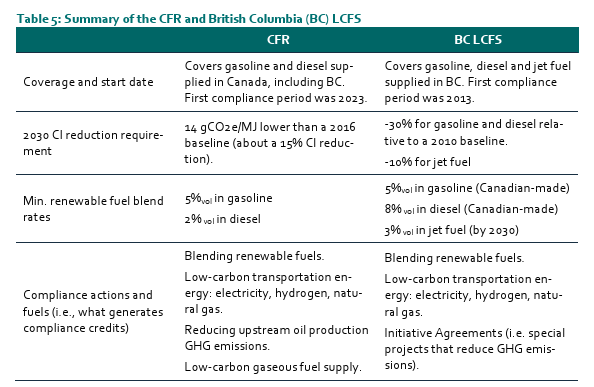

The CFR replaced the older Renewable Fuels Regulations with a modern, flexible framework modelled after successful programs like California’s Low Carbon Fuel Standard (CA LCFS) and British Columbia’s Low Carbon Fuel Standard (BC LCFS). Instead of requiring fixed volumes of renewable fuels, it rewards measurable reductions in lifecycle GHG emissions per unit of energy supplied (gCO₂e/MJ).

As obligated parties, fuel producers and importers must meet progressively tighter CI benchmarks, which decline by 1.5 gCO₂e/MJ annually. Those who exceed the reduction goals can sell their surplus credits; those who fall short must purchase credits to meet compliance. This market-driven system encourages competition, innovation, and cost-effective emission reductions.

Primary suppliers (domestic producers and importers of gasoline and diesel) are given a suite of options to meet their targets, including improving the CI of their fuel production, supplying clean fuels or purchasing compliance credits. Each credit represents one tonne of CO₂ equivalent (CO₂e) avoided, and can be generated through a range of activities, including the production or supply of low-CI fuels, deploying electric vehicle (EV) infrastructure, fuel switching, and switching (e.g. supplying RNG and/or hydrogen).

Credit values and revenue streams

Over the past two years, CFR credit prices have climbed as demand for clean fuels and compliance options has surged. Average values have ranged between $93-$370 per tonne of CO₂e reduced, rising steeply to around $217 per tonne by mid-2025, with spot prices approaching $370 late in the year.

For opt-in participants who voluntarily generate credits, the program has turned climate action into a meaningful business opportunity.

- At current prices, EV charging station owners can earn roughly $0.03–$0.06 per kilowatt hour (kWh) of electricity dispensed, depending on grid carbon intensity.

- Fleets replacing heavy-duty vehicles with EVs typically earn between $0.15–$0.55 per kWh dispensed

- For RNG or low-carbon fuels, credit earnings correspond directly with their CI advantage—making ultra-low or even negative-carbon types especially valuable.

In provinces like British Columbia and Quebec, where grids are cleaner and renewable mandates stronger, these values tend to be on the higher end, further incentivizing regional leadership in clean energy.

Fuel mix shifts: RNG and biofuels

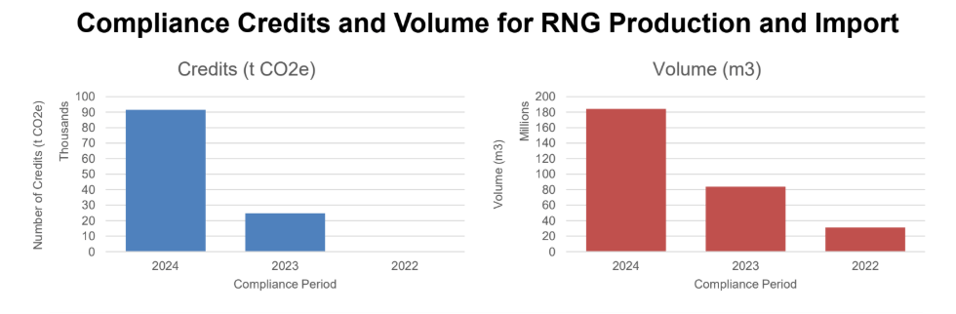

No aspect of the CFR’s impact has been more striking than the transformation in RNG supply.

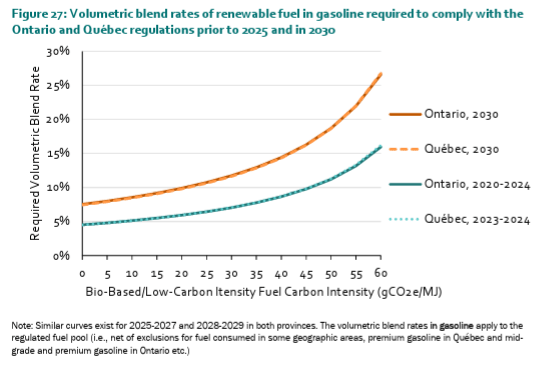

Between 2023 and 2024, RNG volumes registered under the regulation soared by an astonishing 417 per cent, surpassing all other regulated fuels. This boom stems from expanding anaerobic digestion capacity, long-term supply deals across North America, and Quebec’s rising RNG blending requirements—5 per cent by 2025 and 10 per cent by 2030.

Canadian RNG is not only growing in volume but also getting cleaner. CI values for RNG have improved sharply, both in terms of pathways and the overall average.

Early CFR data show that in 2023–2024, many RNG pathways clustered in a positive CI range, with average values in the mid‑60s gCO₂e/MJ (grams of carbon dioxide equivalent per megajoule) in early 2024, but by early 2025, the average RNG CI had fallen to about 24 gCO₂e/MJ, an improvement of around 6 per cent. In addition to this, reported minimum CI values for some dairy and swine manure RNG pathways have reached about 106 gCO₂e/MJ, meaning they remove more carbon than they emit over their lifecycle.

Biofuels also remain central to the equation. Renewable fuel use grew by 28 per cent in 2023 and another 11 per cent in 2024 as ethanol, biodiesel, and RD blends multiplied across the national fuel pool.

Ethanol continues to provide baseline stability, while biodiesel and RD imports fluctuate seasonally with credit prices and harvesting cycles.

Recent changes to US fuel incentives and cross-border trade have further incentivized rapid growth in Canada’s domestic biofuel production. The CI of these fuels are also dropping in a corresponding manner. RD and ethanol have achieved reductions of roughly 20 per cent to 37 per cent from early reporting years, reflecting efficiency gains and cleaner feedstocks.

Provinces leading in compliance

Though the CFR sets national standards, provincial programs and grid differences mean that results vary across Canada.

- British Columbia remains the national leader, leveraging its mature LCFS and high renewable power share to drive deep CI reductions in both transportation and electricity.

- Quebec’s aggressive RNG mandates have propelled it to the forefront of renewable gas adoption and spurred major long-term contracts with producers in both Canada and the U.S.

- Ontario has posted notable progress through increased ethanol and biodiesel blending, coupled with strong investment in EV infrastructure.

- Nationwide, continued grid decarbonization (with a 53 per cent drop in emissions since 2005) has amplified the clean fuel impact by lowering the CI of both electricity and hydrogen production.

Together, these regional efforts are proving that collaboration between federal and provincial programs magnifies the effectiveness of Canada’s climate policy framework.

Credit market dynamics, policy evolution

The CFR’s second year has brought a maturing credit trading market, with transactions roughly doubling annually as new participants enter. Credit accumulation from early overcompliance and conversions from prior renewable fuel programs created an initial surplus, but analysts now anticipate a drawdown in banks as targets become stricter.

The end of 2024 also saw the first activation of the Compliance Credit Clearance Mechanism (CCM), a government backstop that offers credits at a fixed price (currently $319 per tonne) to entities that did not secure sufficient credits on the open market. This policy tool, common in regulatory markets, creates a safety valve that caps potential compliance costs while maintaining market integrity.

An eventful year in US biofuel policy continues to test the resiliency of the CFR program. The elimination of the US Blenders Tax Credit and the introduction of the US Production Tax Credit (45Z) have disadvantaged Canadian-produced biofuels relative to US alternatives, fundamentally altering cross-border fuel flows. Additionally, the high percentage of CFR credits generated from imported US fuels raises concerns about the stability of the program amid global trade shifts and tariff threats.

This fall, the federal government has responded with multiple measures to support the development of the Canadian biofuels sector and the resilience of the CFR program.

Starting January 2026, a $370 million biofuel production incentive will provide much-needed financial relief to Canadian biodiesel and renewable diesel producers, stabilizing the industry. This measure will be complemented by changes to the CFR program to create longer-term demand signals for domestically produced biofuels, which will likely come in the form of domestic content requirements or a credit multiplier for domestic fuels.

These changes reflect the maturation of a program designed to spur investment via steady demand signals. Importantly, the actors driving CFR progress are no longer limited to utilities and fuel suppliers. Corporate fleets, infrastructure owners, and industrial energy users are all participating, viewing CFR compliance and credit generation not as regulatory burdens but as long-term investment opportunities.

3Degrees: an invaluable ally

The developments over the last couple of years demonstrate the CFR’s effectiveness in stimulating innovation, diversifying the national energy mix, and fundamentally changing the economics of decarbonization.

As the targets tighten and the market matures, we can expect the CFR to play an even more critical role in achieving Canada’s ambitious climate goals. The next phase will test how effectively the market can sustain rapid scaling, but the outlook remains positive.

As one of the most experienced partners in clean fuel markets, 3Degrees has helped clients generate, manage, and monetize credits across North America since the inception of clean fuel markets. We support organizations in navigating the evolving Canadian credit market—streamlining credit registration, verification, and sales processes—so you can capture the full value of cleaner fuels.

Connect with our team to learn how 3Degrees can help your organization engage with the CFR.