The Q3 2024 numbers mark an all-time high for the Canadian EV sector with S&P predicting that EVs will make up 15.2 per cent of all light-duty vehicle sales in 2024

The S&P Global Q3 2024 numbers mark an all-time high for the Canadian EV sector with 1 in every 6 vehicles sold in Canada now a ZEV

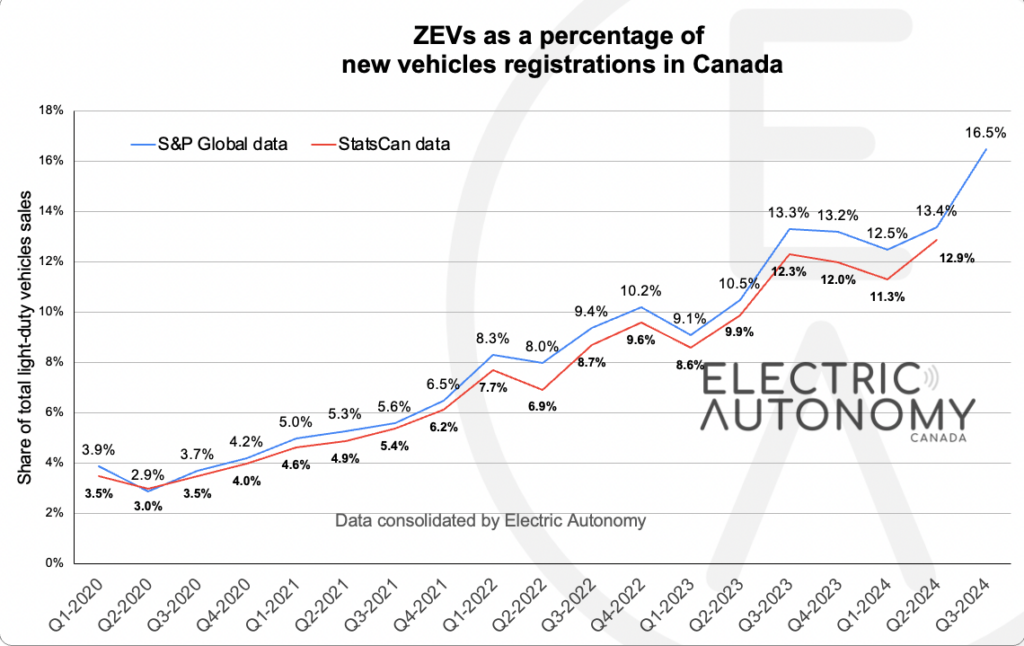

Canadian zero-emission vehicle adoption hit an all-time high in Q3 2024 with S&P Global data showing battery-electric and plug-in hybrid electric vehicles made up 16.5 per cent of all new vehicle registrations in the quarter.

“This means that [in Q3 2024] approximately 1 in every 6 new cars registered in Canada was a ZEV,” reads the report. “This growth reflects a 14.4% increase in overall ZEV volume compared to the previous quarter, driven by a 15.1% rise in BEVs and a 12.4% increase in plug-in hybrid electric vehicles (PHEVs).”

S&P predicts the leap — up from 13.4 per cent in the second quarter of this year — puts Canada on track to surpass 15 per cent new zero-emission vehicle (ZEV) sales for the year.

As part of its long-term forecasting, S&P is projecting that, were Canada to maintain its current adoption trajectory, the country could reach 25.3 per cent new ZEV sales by the end of 2026 and more than 30 per cent by the end of 2027.

(Note: S&P Global Mobility, like Statistics Canada, classifies BEVs and PHEVs as “zero-emission vehicles.” The grouping does not reflect Electric Autonomy‘s view, which considers only non-combustion engine vehicles to be zero-emission. However, where statistics in this report refer to ZEVs, we have adhered to the S&P Global definition for consistency.)

Looking only at battery-electric vehicles (BEVs), Canada’s adoption rate hit 12.2 per cent in Q2 2024 versus 9.9 per cent in Q2.

For plug-in hybrid electric vehicles (PHEVs), the Q2 2024 adoption rate is 4.3 per cent, up from 3.5 per cent in Q2 2024.

Overall, states the report, ZEV volume in Canada increased 14.4 per cent, even though total light-duty vehicle sales volume actually declined by 6.8 per cent.

Highest adoption areas

Quebec is streaking into the lead among all provinces for ZEV adoption.

The province attained 34.6 per cent new ZEV sales in Q3 2024, up from 28.4 per cent in Q2. S&P speculates that Quebec’s adoption rate is largely due to “strong provincial incentives.”

As the report states, “Quebec accounted for 53.8 per cent of all ZEV registrations in Canada [in Q3], up from 50.8 per cent in Q2, highlighting its dominant role in the national market.” S&P also reveals that “75 per cent of the models with an MSRP below $65,000 have a higher market share in Quebec than in the rest of Canada.”

British Columbia is also seeing a jump to 24.9 per cent in Q3 2024, up from 21.8 per cent in Q2.

Yukon, Prince Edward Island and Ontario round out the top five spots at 10.3 per cent, 9.6 per cent and 9.0 per cent, respectively.

Medium- and heavy-duty ZEV adoption

The Q3 2024 S&P report also looked at registrations of electric medium- and heavy-duty vehicles (MHDVs), noting some growth and some declines in Canada this quarter.

S&P reports Class 3, 6 and 7 trucks registered so far this year took a downturn (Class 7 showed the largest dip), while Class 4, 5 and 8 trucks all saw modest to meaningful upswings.

The report says that while some sectors of the medium- and heavy-duty vehicle category “show growth and new entries, others face challenges that need addressing to enhance ZEV adoption.” The authors conclude that “continued investment in technology and infrastructure will be crucial for future expansion.”