There are some things you will want (and need) to know about participating in clean fuel regulation credits in North America, says 3Degrees

Ever wonder how the Clean Fuel Regulations work and how you can get involved? 3Degrees shares the answers to its most commonly asked questions. Photo: 3Degrees

There are some things you will want (and need) to know about participating in clean fuel regulation credits in North America, says 3Degrees

This article is Sponsor Content presented by 3Degrees.

Canada’s Clean Fuel Regulations (CFR), which came into effect in July 2023, are a critical component of the country’s effort to reduce greenhouse gas (GHG) emissions from the transportation sector.

As a program designed to lower the carbon intensity (CI) of fuels, the CFR offers opportunities for businesses to generate credit and access funding for fleet decarbonization.

In this Q&A, we’ll explore key details of the CFR, how it works, and how companies can benefit.

CFR FAQs

What are the Canadian Clean Fuel Regulations (CFR) and why were they introduced?

The Clean Fuel Regulations is an approach the Canadian government has taken to reduce transportation emissions by setting targets for carbon intensity each year, where those targets decline over time.

CI is a life cycle assessment of the emissions produced from transportation fuel. It takes a ‘well to wheels’ approach, which means it looks at every step — from the extraction and refining processes to when fuel gets dispensed into vehicles.

The CFR program established a target of a 15 per cent reduction in CI by 2030, and it came into full effect on July 1, 2023.

Prior to July 1, 2023, entities were eligible to generate credits but obligated parties did not start accruing their obligations until that date.

How do the Clean Fuel Regulations impact carbon intensity (CI) reduction?

The CFR establishes a carbon intensity target that decreases year-over-year, with a goal of achieving a 15 per cent reduction below 2016 levels in carbon intensity by 2030, with the benchmark declining by 1.5 points per year.

Carbon intensity (CI) refers to the emissions per unit energy of fuel used. The target applies to all transportation fuel sold, supplied, or offered for sale within the program’s region, sometimes with exceptions for certain industries.

Producing or importing certain volumes of conventional gas or diesel with a CI above the target generates deficits in proportion to how far above the fuel’s CI is from the target. Supplying or importing alternative fuels with a CI below the target and end-use fuel switching (e.g., operating EV chargers) generates credits, with each credit representing a reduction of 1 mtCO2 e.

Which fuels are covered under the CFR?

Any fuel used for transportation purposes is covered under the CFR, including biodiesel, electric, renewable natural gas, hydrogen, low carbon gasoline, ethanol and renewable diesel.

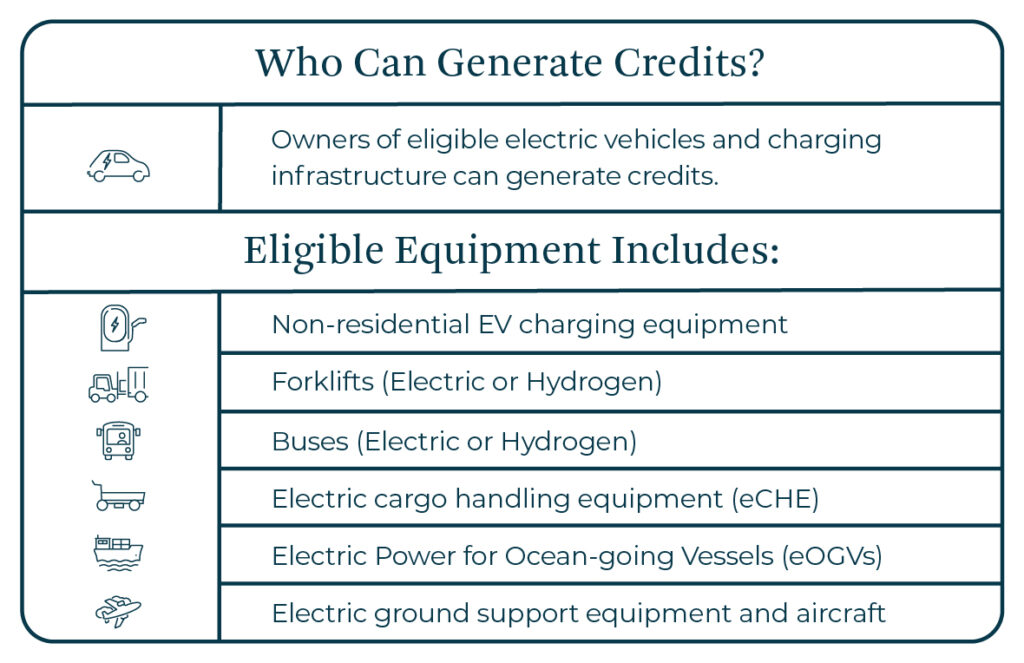

Owners of eligible electric vehicles and charging infrastructure can generate credits.

The owner or operator of a hydrogen fuelling station can generate credits based on the amount of hydrogen dispensed and the carbon intensity of the hydrogen. Both liquid and gaseous hydrogen are eligible for credit generation.

Eligibility and crediting for renewable natural gas (RNG) is similar to hydrogen applications, but there are additional documentation requirements.

What sectors are affected by the CFR? What are the penalties for non-compliance?

The transportation fuels sector as a whole is regulated, which means that gas and diesel producers are automatically affected.

Entities in the alternative fuels sector — including biofuel producers, EV charging businesses and public agencies — can benefit from the CFR but are not obligated to participate.

The aviation and marine sectors can opt-in as well, but are exempt from compliance at this time.

Obligated parties that do not meet the carbon intensity reduction targets are deficit generators and must purchase credits in the market.

What is the difference between the CFR and the previous Renewable Fuels Regulations (RFR)?

The CFR replaced the RFR. The key difference between the CFR and RFR is a focus on lifecycle GHG emissions rather than volumetric blending requirements for renewable fuels.

Similar low carbon fuel programs exist in California, Oregon, Washington and the province of British Columbia; however, the CFR is the first national low carbon fuel program in North America.

How does the CFR interact with provincial fuel standards (i.e. the British Columbia LCFS)?

The British Columbia LCFS was established in 2010 and operates separately from Canada’s federal CFR.

The two credit systems are stackable, meaning credits can be generated for eligible activities taking place in British Columbia under both the BC-LCFS and the CFR programs, however, reporting is handled separately.

These credits are not fungible, meaning the CFR credits generated can only be sold and used in the CFR market and the same goes with the BC-LCFS credits in its respective market. Each market has different supply and demand dynamics, thus pricing dynamics vary. Reporting is also handled separately.

From a credit spend perspective, when the CFR requirement for charging network operators to submit credit generation reports to ECCC each year, only the CFR credit generation validation needs to be reported. When generating credits under the BC LCFS, credits don’t need to be submitted to ECCC.

What are the eligible applications for credit creation under the CFR?

Credit generation varies by vehicle type, fuel type and province (for electric vehicles). Credit pathways under the CFR include:

- Lifecycle CI Reduction: Implementing measures to lower the CI of fossil fuels throughout their lifecycle.

- Low-Carbon Fuel Supply: Providing alternative fuels with lower emissions, such as ethanol and biodiesel.

- Direct Vehicle Fueling: Supplying low-carbon fuels directly to natural gas vehicles, hydrogen fuel cell vehicles (HFCVs), and electric vehicles (EVs). Examples of low-carbon fuels include biogas, RNG and hydrogen.

- Charging and Fueling Infrastructure: Supporting the development of electric vehicle charging and hydrogen fueling stations by allowing infrastructure to generate credits even when not utilized.

Most on-road and off-road vehicles using low-carbon fuels are eligible to generate credits.

The CFR includes a broad range of equipment, supporting the transition to cleaner fuel sources across various industries. Eligible equipment under the CFR includes non-residential EV charging equipment, forklifts (electric or hydrogen), buses (electric or hydrogen), electric cargo handling equipment (eCHE), electric power for ocean-going vessels (eOGVs), electrical ground support equipment (GSE) and electric aircraft.

Associated serial numbers are used to distinguish each unique identifier, denying future registrations of that piece of equipment or vehicle. Residential chargers are not eligible under the CFR because the entity selling the equipment would get to claim that credit.

Municipalities, transit agencies, private fleets, school bus operators, and charging network operators are just some of the groups typically eligible to generate credits.

How are compliance credits generated?

The CFR has multiple credit types:

- CC1: Credits from emission-reduction projects that lower the CI of fuels

- CC2: Credits from producing or importing low-CI fuels (e.g. biofuels, synthetic fuels)

- CC3: Credits from end-use fuel switching, such as supplying alternative fuels at fueling stations or charging EVs

For example, almost everybody that has an EV being charged will be generating compliance category 3 liquid class credits, with the assumption that it’s likely displacing gasoline.

However, a forklift would likely generate category 3 gaseous class credits, because in this case, propane is typically being displaced rather than displacing diesel or gasoline in other applications.

How does the credit market work under the Clean Fuel Regulations?

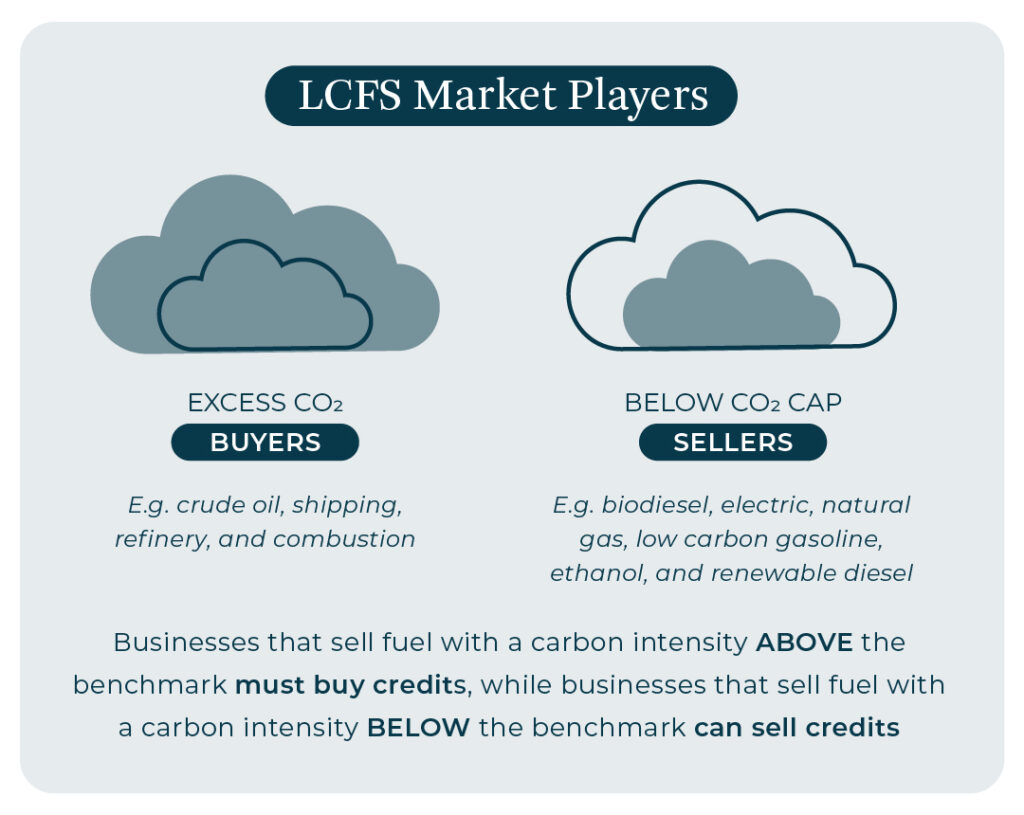

Businesses that sell fuel with a carbon intensity above the benchmark must buy credits, while those with a carbon intensity below the benchmark can sell credits.

Every year deficit holders are required to produce or procure enough credits to offset their deficits. This structure creates a market where credit holders can sell their credits to generate value from using lower-carbon fuels. Credits are primarily generated for displacing gasoline or diesel fuels.

These credits are tracked and managed through an online database where deficit and credit generators register and create accounts.

Who can create and trade credits under the CFR?

Credits are created based on the quantity and carbon intensity of low-carbon fuel supplied. Entities who undertake credit generation activities are referred to as registered creators and there are numerous credit generating activities available (see above).

To generate credits, registered creators must submit detailed registration information, such as the charging type, vehicle type that’s being charged, and unit capacity. Fuelling session data must be tracked and reported quarterly.

Voluntary credit creators are non-obligated parties that voluntarily elect to use, produce or sell clean fuels. For example, fleet operators can earn credits by supplying their vehicles with low-carbon fuels, such as electricity, hydrogen, or renewable natural gas. Credits for EVs can be generated for light-duty and heavy-duty vehicles, including off-road vehicles, where the fuel used is displacing gasoline or diesel fuels.

Charging network operators — including those who operate a charging communication platform and own the associated data, charging-site hosts, or those who lease or own chargers and have the legal right to install chargers — may also generate credits.

How can fleets and fuel suppliers benefit from the CFR? What financial opportunities are available through the CFR?

By using low- or zero-emission fuels your organization is decreasing petroleum dependence in the transportation sector and contributing to the global fight against climate change. Generating credits for your low-carbon activities through participating in the CFR can financially benefit your organization. Revenue from credit sales can be used to further aid your transition to a zero-emission vehicle fleet, or simply help offset the cost of your initial investments.

Additionally, while the upfront costs for many ZEVs are higher, the transition to cleaner, zero-emissions technologies lowers operating and maintenance costs which, when coupled with incentives like those represented by the CFR, can lead to a lower cost of ownership (TCO).

Fleet operators transitioning to electric, hydrogen, or renewable natural gas vehicles can earn CFR credits to lower long-term operating costs.

Furthermore, demonstrating a commitment to sustainability has been proven to enhance brand reputation and attract eco-conscious segments of the consumer market. Entering into the CFR by making investments in low-carbon transportation can ultimately support your company’s values and mission, while also establishing a competitive edge.

Participating in these programs doesn’t disqualify you from any grants or incentives you are already receiving or are seeking.

Are there credit spend requirements under the CFR?

Charging network operators must use credit revenue to fund residential or public EV infrastructure expansion, subsidize EV ownership costs (by providing incentives for the purchase of EVs), or upgrade electricity distribution systems supporting EVs.

Other voluntary participants are encouraged to (though not required) to reinvest proceeds into clean fuel adoption or technology deployment. Even in cases where reinvestment isn’t mandated, the CFR was designed to channel funds to organizations that are actively advancing the low-carbon fuel market in Canada. This in turn, creates a steady cycle of incentives and reinvestment, helping to accelerate the growth of the clean fuel sector.

How to get involved

For organizations exploring ways to speed the transition to low-carbon transportation, participation in CFS programs offers a lucrative method for satisfying the growing pressure to use low-carbon technologies.

Having generated some of the first credits under California’s LCFS in 2013 and roughly 200,000 CFS credits to date, 3Degrees is an expert in the transportation markets space. We are here to alleviate the administrative burden and help organizations recognize the highest possible value for participating in programs like Canada’s CFR.

We can support you in entering CFS markets, generating and monetizing CFS credits and developing emissions reduction projects within the transportation sector.

Please reach out for help in meeting your unique business needs and sustainability goals.

To stay in-the-know on all things clean fuels, we invite you to sign up for 3Degrees’ quarterly Transportation Markets Report, where we share market trends, regulatory updates and clean fuel sector developments.