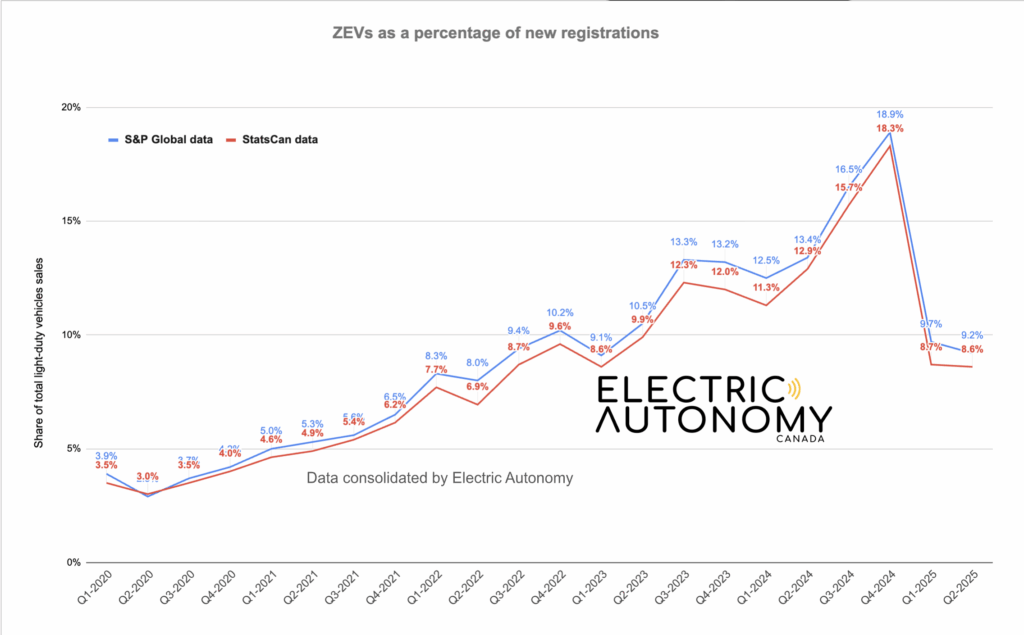

Electric vehicle sales continued to be sluggish in the second quarter of 2025, dipping from 9.7 per cent in Q1 to 9.2 per cent in Q2

Canada’s ZEV adoption rate dropped to 8.6 per cent in Q2 2025, according to S&P Global data. Image: Electric Autonomy

Electric vehicle sales continued to be sluggish in the second quarter of 2025, dipping from 9.7 per cent in Q1 to 9.2 per cent in Q2

New data from S&P Global indicates zero-emission vehicle sales continued to struggle in Q2 2025, reaching just 9.2 per cent — a 0.5 per cent decrease from Q1 2025.

Overall battery-electric vehicle sales accounted for 5.9 per cent of all new vehicle sales in the second quarter, meanwhile plug-in hybrid electric vehicles (PHEVs) made up 3.3 per cent.

“The national ZEV decline is almost entirely driven by corrections in Quebec and British Columbia (B.C.), though in very different ways in each province,” reads the S&P report.

“The correction in the BEV market is exacerbated by the significant decline in market share from its long-time leader, Tesla. As Tesla’s dominance has waned from more than 40 per cent to single digits, competitors have captured some of that share, but a significant portion of potential buyers appear to be opting for hybrid alternatives instead of another BEV.”

(Note: S&P Global Mobility, like Statistics Canada, classifies BEVs and PHEVs as “zero-emission vehicles.” The grouping does not reflect Electric Autonomy’s view, which considers only non-combustion engine vehicles to be zero-emission. However, where statistics in this report refer to ZEVs, we have adhered to the S&P Global Mobility definition for consistency.)

Rise of the passenger hybrids

The key message in S&P’s latest report is that Canada has entered the age of the hybrid-electric vehicle (HEV).

“The Canadian consumer has spoken, and the message is clear: the practicality of hybrids is currently paving the road to electrification,” states S&P.

Currently, HEVs are not considered zero-emission vehicles in Canada. This is because they use a combustion engine to “charge” an on-board battery motor as well as regenerative braking.

However, across Canada, S&P reports that HEVs are outselling BEVs and PHEV’s by significant margins.

“In a complete flip from one year ago, full hybrids alone (12.9 per cent) now outsell the entire ZEV segment (9.2 per cent),” reads the report.

Quebec, says S&P, remains a BEV stronghold in Canada, while every other jurisdiction is seeing HEVs sales dominate.

Policy shake up

Given the pivot in consumer behaviour, is Canada facing a policy shift to reflect a changing passenger vehicle auto market?

“The current market trajectory, with consumers favoring non-ZEV hybrids, creates a substantial gap between market reality and the federal government’s ambitious ZEV sales targets,” cautions S&P.

“This disconnect poses a strategic challenge for automakers and policymakers alike.”

At this stage it’s difficult to predict what longterm moves the government may make.

The federal Liberal government is currently in a consultation period following the deferment of the original 2026 interim ZEV mandate adoption target earlier this year.

If nothing else, S&P says the sales data shows there is a massive upheaval in which OEM’s are “top sellers” in Canada, with now Toyota, Honda and Korean automakers claiming significant ground because of their HEV product offerings.

Meanwhile, in the MHDV segment

While the passenger vehicle segment is trending towards HEVs at the moment, the medium- and heavy-duty vehicle (MHDV) segment appears to be doubling down on battery-electric.

“While the Canadian consumer market is overwhelmingly embracing hybrids as a transitional technology, the commercial medium and heavy-duty commercial vehicle (MHCV) sector tells a starkly different story,” reads the report.

“Here, the path to decarbonization is more volatile and the role of hybrids is rapidly diminishing.”

S&P goes on to detail how the MHDV segment is moving towards decarbonization with more highs and lows in adoption, but that the technology is consolidating around fully-electric powertrains.

Fuel cell vehicles and hybrid-electric powertrains, says S&P, are decreasing in adoption.

“For MHCVs, the story is not one of uniform, linear growth for ZEV commercial vehicles. Instead, the data points to a market in its early, experimental stages,” says S&P.

“Lighter-duty commercial vehicles (Class 2B) show a more mature but recently declining penetration, while mid-range classes (Classes 3, 4, 5) and the heaviest class (Class 8) are demonstrating a slow, erratic, but generally upward trend from a near-zero base.”