The end of subsidies and a trade war with the U.S. drive ZEV adoption down in Canada

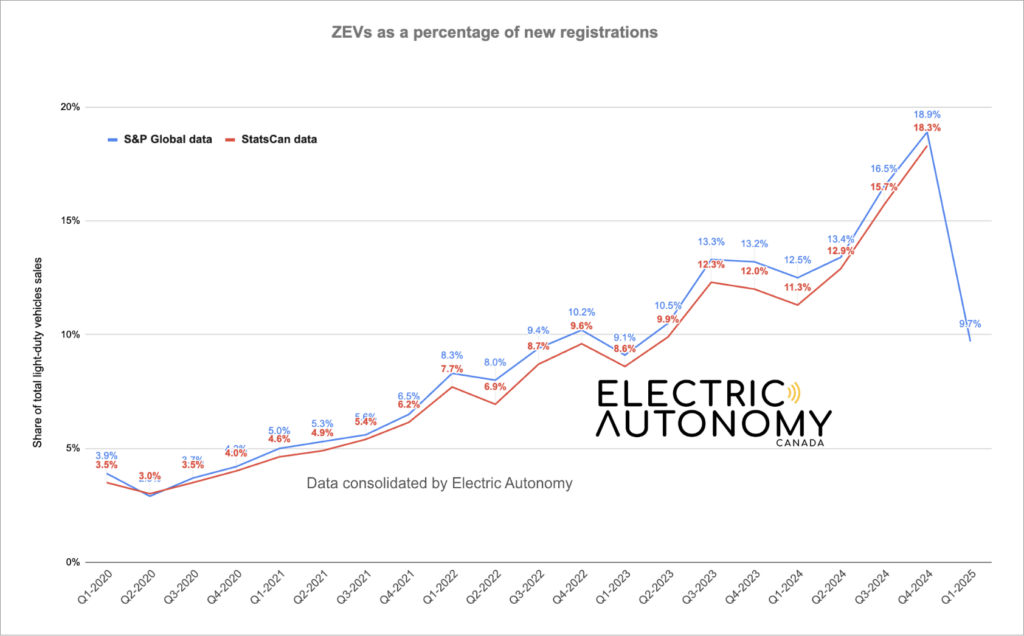

Canada’s ZEV adoption rate dropped to 9.7 per cent in Q1 2025, according to S&P Global data. Image: Electric Autonomy

The end of subsidies and a trade war with the U.S. drive ZEV adoption down in Canada

In Q1 2025, ZEV registrations in Canada fell to just 9.7 per cent — down from 18.9 per cent in Q4 2024, according to new sales data from S&P Global.

It’s not a positive start to the year for zero-emission vehicle adoption in Canada. But it’s also not unexpected; the disruption of several provincial and federal rebate programs in January and February, a trade war with the U.S., and other negative economic factors weighed heavily on consumers’ minds.

“The Q1 2025 performance of Canada’s ZEV market reveals a significant slowdown relative to Q4 2024 and a downward shift compared to Q1 2024,” reads the S&P report.

“With ZEV market share dropping from 18.9 per cent in Q4 2024 and from 12.5 per cent in Q1 2024 to just under 10 per cent in Q1 2025, stakeholders must carefully evaluate the interplay between regulatory adjustments, economic conditions, and consumer preferences.”

(Note: S&P Global Mobility, like Statistics Canada, classifies BEVs and PHEVs as “zero-emission vehicles.” The grouping does not reflect Electric Autonomy’s view, which considers only non-combustion engine vehicles to be zero-emission. However, where statistics in this report refer to ZEVs, we have adhered to the S&P Global Mobility definition for consistency.)

BEVs, PHEVs hit harder

Breaking down the S&P data, it becomes clear that battery-electric and plug-in hybrid-electric vehicles are seeing a particularly sharp downturn.

“In Q1 2025, the EV segment witnessed a dramatic drop of more than 56.1 per cent, while PHEV sales similarly fell by approximately 44.0 per cent compared to Q4 2024,” reads the report.

“This stark comparison underscores a significant slowdown in ZEV sales at the very start of 2025, potentially driven by market dynamics and incentive restructures.”

Hybrid-electric and combustion vehicles, meanwhile, saw a slight increase in sales between Q4 2024 and Q1 2025.

And of all the auto brands who have seen a decline in EV sales, Tesla is bearing the brunt of the impact, finds S&P.

“Once the undisputed leader, Tesla’s market share has plummeted from nearly half of all ZEV registrations in early [2022] to less than 10 per cent by April 2025.”

Quebec rebound?

The S&P report says in its forward-looking statement that while Q1 2025 was a meaningful dip for ZEV adoption in Canada, there is overall optimism that the difficulties are temporary.

“Although short-term setbacks are evident, we expect regulatory efforts and industry innovations to support the continued evolution of Canada’s sustainable automotive landscape,” reads the report.

“Our projections suggest that Canada’s EV market could experience substantial growth rates, potentially bolstering overall vehicle sales by pushing automakers to introduce more affordable and range-extended models.”

Helping the cause, at least in the short term, is Quebec, which brought back its ZEV subsidy after pausing it in Q1 this year (a move that led to a 65 per cent drop in EV sales in the province).

S&P finds that Quebec is already seeing an uptick in EV sales since the reinstatement, creeping up from 14.8 per cent in Q1 2025 to 16.4 per cent in April 2025.

The other EV adoption leader in Canada, meanwhile, is continuing to see a slowdown since pausing its rebates. The numbers for BC are in line with monthly data from Statistics Canada, which shows national ZEV sales falling again to just 7.5 per cent in April 2025.