In a presentation, environmental service provider, 3Degrees, shares insights on how to capitalize on Canada’s clean fuel regulations

A presentation from 3Degrees demonstrates how operators and site hosts can earn money from their EV charging infrastructure. Photo: Electric Autonomy

In a presentation, environmental service provider, 3Degrees, shares insights on how to capitalize on Canada’s clean fuel regulations

To reduce emissions from transportation and other sectors, Canada implemented the Clean Fuel Regulations (CFR) in July 2023.

A key features of the CFR program is that EV charger operators and site hosts can opt into the program and generate credits from their infrastructure. The credits generate revenue for the operator/host while contributing to Canada’s emissions-reduction goals.

3Degrees is a California-based environmental services provider. They joined Electric Autonomy to discuss how the EV industry can maximize its returns on investments through the CFR.

The presentation and Q&A period delves into how the CFR works, eligibility, the overall value of credits and more.

A summary of the presentation is available below along with a video of the full session.

What are clean fuel regulations?

“The clean fuel regulations is an approach that the Canadian government has taken to reduce transportation emissions,” says David Meyer, director of transportation markets at 3Degrees, during the recent presentation.

“The way they do that is by setting targets for carbon intensity.”

The federal goal is to reduce Canada’s carbon intensity by 15 per cent from 2016 levels by 2030.

Through the federal CFR program, low-carbon fuel producers can generate credits, while fossil fuel producers incur deficits.

Deficit holders must offset their carbon intensity by purchasing credits on the market.

How to opt in

For low-carbon fuel producers, Meyer explains, the CFR program operates by tracking and reporting charging activity. As soon as the credit collector registers the the charger, it can start generating credits.

Throughout the year, the amount of electricity dispensed into vehicles is tracked. At the end of the year, data collection, verification and formatting occurs — according to requirements set by Environment and Climate Change Canada (ECCC).

This verification process is mandatory and may involve site visits.

Once data verification is complete the regulator issues credits that are eligible to sell on the market.

Companies like 3Degrees manage this entire process for the partners that they work with.

“We operate as what’s known as an aggregator,” explains Meyers.

In this role, 3Degrees manages reporting, ensures compliance with verification requirements, oversees credit issuance, facilitates sales and then shares the revenue with its partners.

Additionally, 3Degrees helps partners access incentives from other clean fuel standard programs in Canada, such as British Columbia’s Low Carbon Fuel Standard (LCFS), and U.S. programs like California’s LCFS, Oregon’s Clean Fuels Program and Washington’s Clean Fuel Standard.

Notably, the CRF and British Columbia’s LCFS program are stackable for additional benefits, says Meyers.

Eligibility requirements

In the EV space, eligibility to claim credits falls into two categories: charging network operators and charging site hosts.

Charging network operators provide charging stations in public or residential areas.

“In the charging network operator case, the credit generating entity is the entity that owns the data that is associated with that charger,” says Meyer.

For a charger to be eligible it must appear on an app and be available for public use.

Under the federal CRF, charging network operators have to reinvest all credit proceeds into expanding their network or reducing costs to own and operate. They also need to submit annual documentation showing proof of this to ECCC.

The second group eligible to claim credits is charging site hosts. These are entities that have chargers for private use, such as businesses with fleet vehicle chargers at their warehouses.

Meyers explains that individual homeowners can’t generate credits because, when purchasing a charger, they typically enter into an agreement that gives the seller rights to the data from that charger. As well, most home chargers are not “smart chargers” in that they aren’t able to meter the energy consumption from the charger in a way that is acceptable to the ECCC when validating credits.

However, multi-unit residential buildings may be able to generate credits from their chargers as they act as site hosts.

Money on the table

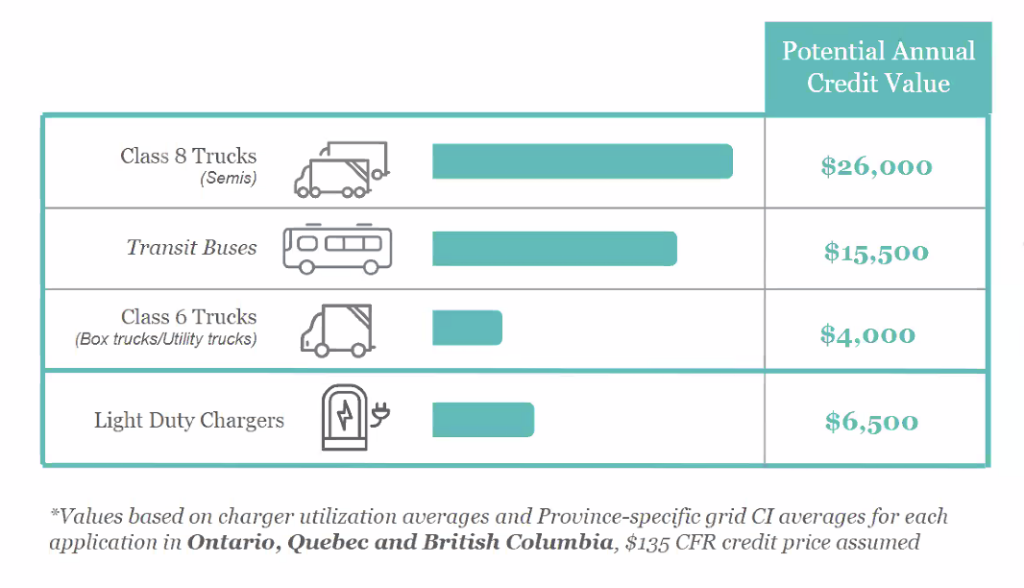

The value of CFR credits depends on three factors: vehicle type, how clean the fuel (electricity) is and volume of consumption.

Vehicles are classified as either light-duty (weighing under 6,000 pounds) or heavy-duty (over 6,000 pounds), but the end-to-end cleanliness of the fuel varies by province.

In provinces with cleaner grids that supply power to EV chargers, such as Quebec, and British Columbia, credit value is higher. However, provinces like Alberta, which have higher carbon-emitting grids, tend to see lower credit values, says Meyers.

But ultimately, Meyers points out, how much a CFR credit is worth comes down to how much use a charging station gets.

And there is a crucial tip: each case is unique.

“Class 8 semi-tractors that are used very heavily are going to be able to generate a significant amount of credit value [for the charger]. Whereas something like a box truck that might be used off-and-on, intermittently and isn’t as power hungry, might not generate as much credit revenue,” says Meyers.

“[But] these are representative estimates and we’d be happy to…help you better understand what this looks like specifically for you.”