Now dominating China’s full-size SUV market, extended-range electric vehicles saw 1.5 million global sales in 2025. They may be arriving in Canada and the U.S. soon, says Frik Els

The Li Auto L9 is an extended-range EV built in China. Photo: Li Auto

Now dominating China’s full-size SUV market, extended-range electric vehicles saw 1.5 million global sales in 2025. They may be arriving in Canada and the U.S. soon, says Frik Els

What’s old becomes new again is not a phrase that immediately springs to mind when thinking about the world of electric vehicles. But that’s the case with extended-range electric vehicles, or EREVs, which have been enthusiastically adopted by Chinese drivers in a place that sells more full electric and plug-in hybrid electric vehicles (PHEV) than the rest of the world combined. And it’s happening at breakneck speed, with sales of EREVs doubling each year from 2021 to 2024.

EREVs are plug-in hybrids with an internal combustion engine functioning only as a generator to recharge the battery and extend range, without directly powering the wheels. More technically, EREVs use a series configuration versus the parallel systems (or a combination of the two) in conventional PHEVs.

But the EREV is far from a new concept. General Motors’ entry into the EV mass market was an EREV. The Chevrolet Volt even briefly had a Cadillac sibling. Launched late 2010, Volt sales were disappointing and the model was retired in 2019. The Cadillac ELR found fewer than 3,000 buyers during its brief life. BMW took the same route with the i3 REx at a time when the all-electric Nissan Leaf had the market almost to itself.

Refining the original concept

Whether extended-range EVs are their own thing or just a subspecies of PHEVs is still out for debate. (The EU lumps EREVs with fully battery-electric vehicles (BEVs) when calculating tariffs on made-in-China EVs.) But there’s no doubt today’s EREVs are completely different beasts than the Volts and the i3s.

Much of the credit for the EREV lift-off goes to Beijing-based Li Auto, until 2024 an exclusively EREV manufacturer. Li Auto quickly became a top-10 EV brand by moving EREVs upmarket and beefing them up — considerably — to take advantage of changing Chinese EV tastes and growing city-to-city travel in China.

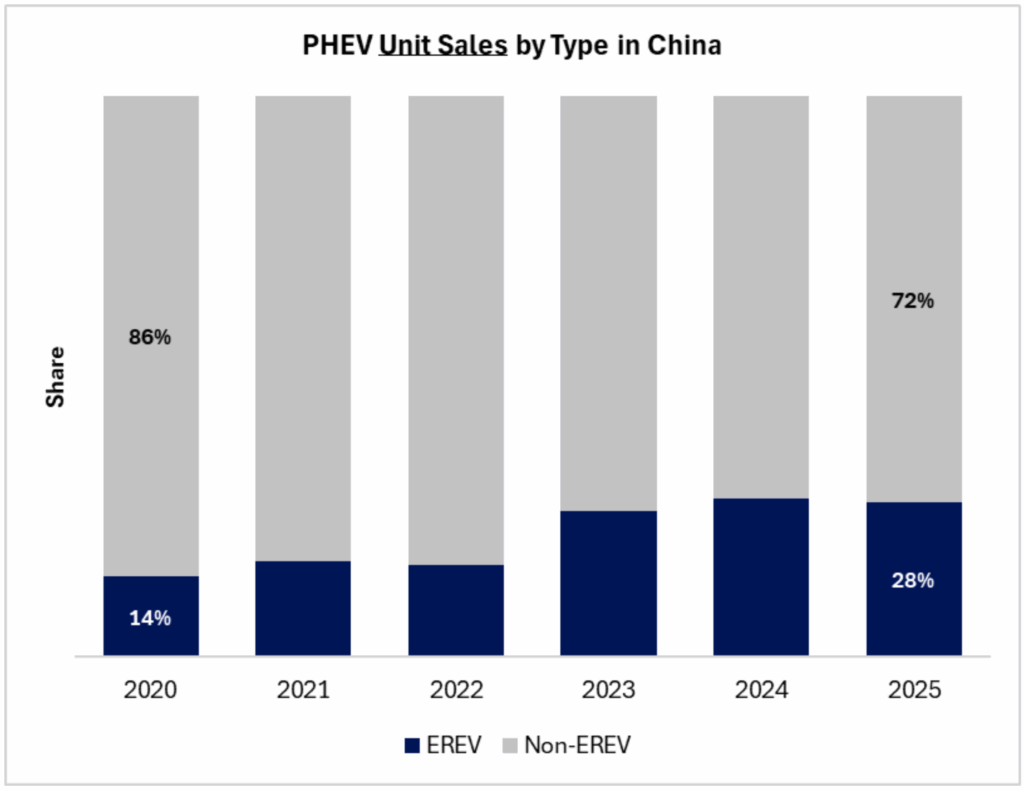

Copycats were soon competing with Li Auto — including the world’s top electric vehicle maker, BYD — and this type of EV has all but taken over the market for large, full-size SUVs and minivan-like multi-purpose vehicles in China. From just more than 60,000 sold in 2020, to nearly 1.5 million in 2025, EREVs represent six out of the top-10 best-selling BEV and PHEV models globally in the large and full-size SUV and minivan segment in 2025. In China, EREVs now make up nearly 30 per cent of the plug-in market in sales terms (Figure 1).

Figure 1. Source: Adamas Intelligence

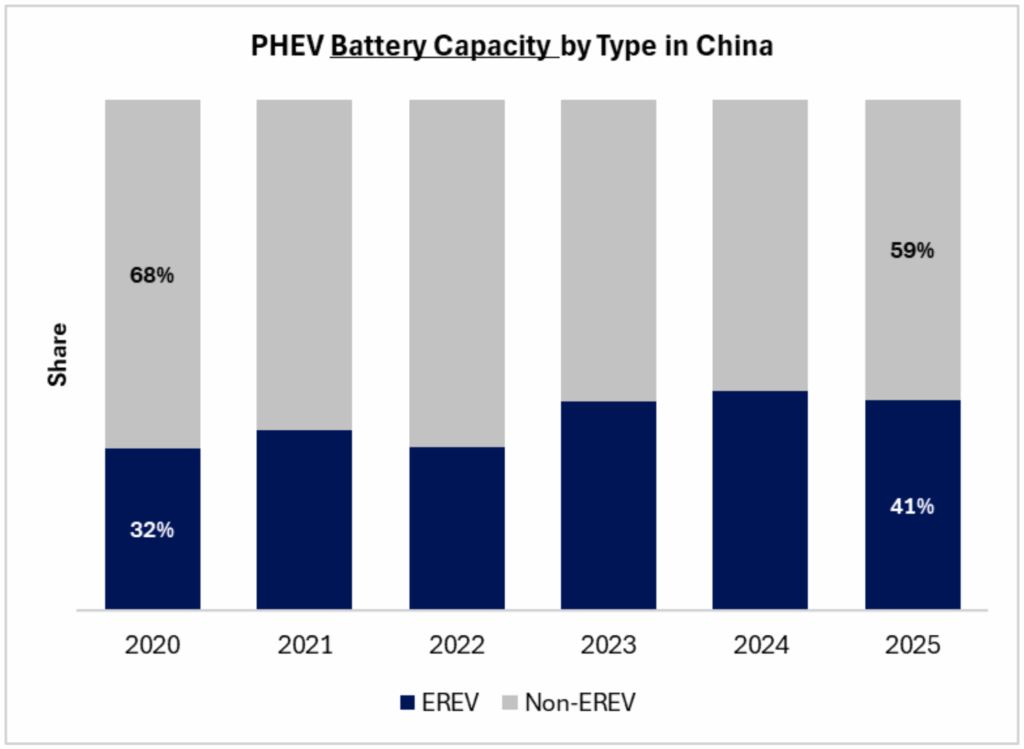

EREV batteries are bulky, coming in at an average of just under 40 kWh, larger than those in most European and Chinese compact and small battery electric vehicles, and almost twice as large as those in the average PHEV. Looking at EREV’s share of battery capacity deployed rather than unit sales alone (Figure 2) clearly shows their potential to accelerate the electrification of the global car parc.

Figure 2. Source: Adamas Intelligence

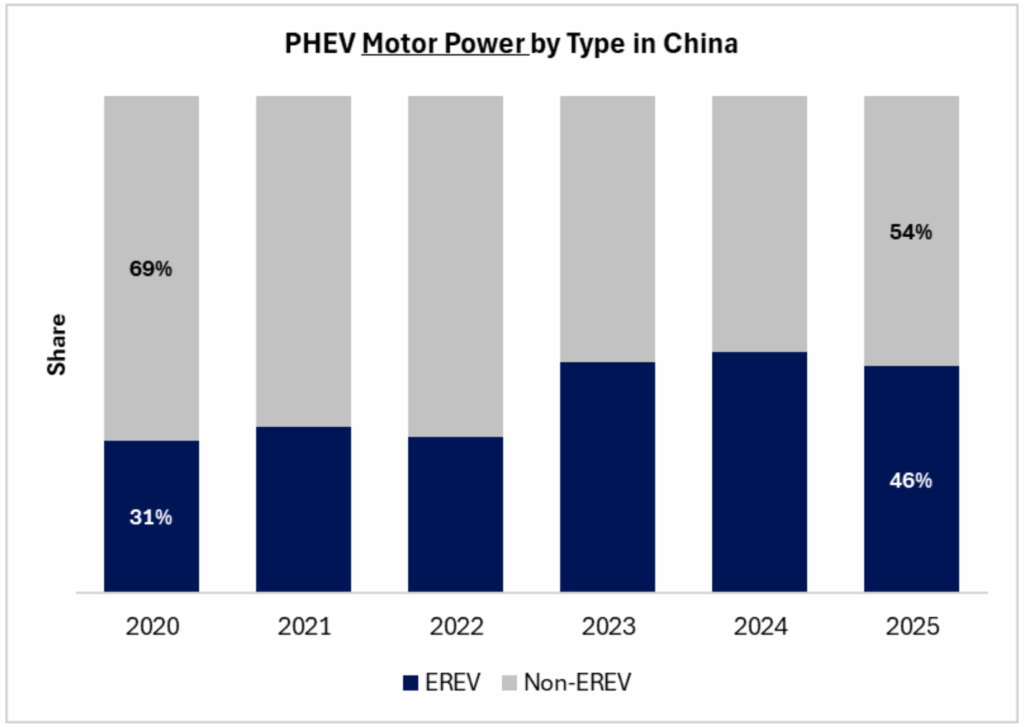

Since the electric motors must do all the heavy lifting to propel these often high-curb-weight vehicles, they tend to be very powerful. Figure 3 shows the share of EREVs of overall PHEV traction motor power deployed (in kW), showing that, just as for battery capacity, range extenders play an outsize role.

Figure 3. Source: Adamas Intelligence

Wrap it all up in a package and it becomes clear why EREVs took the Chinese market by storm. Take the latest model from IM, or Intelligence in Motion, a joint venture between China’s state-owned SAIC Motor and Alibaba (auto and tech tie-ups is another area where China is innovating). The IM LS9 is a full-size luxury SUV with a driving range of a smidgen over 1,500 km range thanks to a frugal 1.5 litre turbocharged gas engine that charges the battery. The IM LS9’s driving range is at least double the best PHEV offering in North American markets. And to boot, 402 km of that driving range is pure electric propulsion.

EREV architecture also provides cost savings to manufacturers and owners: no need for a gearbox or mechanical linkages to the drivetrain, while the engine runs at a constant RPM, optimizing fuel efficiency and reducing wear. This helps explain why IM’s full-spec flagship retails for less than $50,000 in China, which, adding insult to injury, is around the average selling price of a new vehicle in the U.S. and Canada.

The West finally wakes up

OEMs outside of China now seem to recognize the potential of EREVs and are scrambling to add them to their lineups. Stellantis, Ford, BMW, Nissan and Hyundai all say that EREVs are in their future. Mercedes-Benz and others have also made noise about the technology.

That it has taken so long for North American automakers especially to go back to the future is somewhat confounding. Particularly considering the vast driving distances, charging networks that still lag well behind the continent’s refuelling infrastructure, and the popularity of big trucks. But given the many missed deadlines to deliver pivotal models like Ram’s full-size pickup or any EREV in the hot three-row SUV segment, you can understand why North American drivers are getting impatient.

The missed market opportunity and the pent-up demand for a better ICE-BEV in-between are nowhere clearer than Volkswagen’s resurrection of International Harvester’s Scout, the original credited by some as the first-ever SUV long before the term was coined. Volkswagen says that, after 80 per cent of early reservations went towards the EREV versions of the Traveler SUV and Terra pick-up, its efforts will be focused there when production begins next year.

In a segment where power and range are top of mind, EREVs might be the ideal electric competitor to conventional and hybrid ICE vehicles in Canada.

If only they were available.

Frik Els is head of Adamas Inside. Adamas Intelligence is an independent market research and advisory firm focused on mine-to-application supply chains for critical metals and materials, namely REEs and the growing bouquet of different battery materials. Founded in 2012 to help clients make informed decisions involving critical metals and materials, Adamas Intelligence’s industry leading research and advice now supports clients on 6 continents including exploration and mining companies, institutional investors, technology and material developers, OEMs, government agencies and other advisory firms. Adamas is known for rigor, transparency and delivering actionable insights.