While electric vehicles sales are set to rise in 2025, BloombergNEF’s longer term forecast signals a possible slowdown in adoption driven by unstable U.S. policies

BloombergNEF is predicting a slowdown in EV sales globally beyond 2025, but Canada projected to hit 65 per cent adoption in 2040.

While electric vehicles sales are set to rise in 2025, BloombergNEF’s longer term forecast signals a possible slowdown in adoption driven by unstable U.S. policies

For the first time in its annual Electric Vehicle Outlook, BloombergNEF has lowered both its short- and long-term forecasts for global electric vehicle (EV) adoption.

The change reflects growing uncertainties in key markets, particularly the United States, where recent policy shifts have slowed the trajectory of passenger EV sales.

However, despite the projection changes, global EV momentum remains strong — for now.

BloombergNEF expects nearly 22 million battery-electric and plug-in hybrid vehicles to be sold in 2025.

This marks a 25 per cent increase over 2024.

Plug-in vehicles are expected to represent one in four new vehicles sold globally this year (a significant jump from less than five per cent just a few years ago).

“2024 was a landmark year for electrified transport, with electric vehicles hitting global sales highs and rapidly increasing adoption from emerging markets across Asia and LatAm,” says Colin McKerracher, head of clean transport and energy storage at BloombergNEF, and lead author of the report in a press release.

“Despite these positive tailwinds, we see slower EV adoption in the short- and long-term due in large part to the changing landscape in the U.S.”

U.S. slump

BloombergNEF’s forecasts now expects 14 million fewer EV sales in the U.S. between 2025 and 2030 compared to previous estimates.

The revision is due to several American policy changes, including the rollback of federal fuel economy standards, the phase-out of tax credits for EV purchases and the potential weakening of California’s authority to set its own emissions rules.

In Europe, pushback on vehicles’ CO2 reduction targets has also affected the outlook.

“This shift in global adoption will also have major impacts on the battery industry, leading to overcapacity in manufacturing,” adds McKerracher.

Global battery demand projections between 2025 and 2035 fell eight per cent compared to last year’s outlook, equaling 3.4 terawatt-hours fewer batteries.

Most of the decline comes from “decreasing passenger EV sales in the U.S., where demand is 42 per cent less than in last year’s outlook,” reads the report.

According to the report, this shift is contributing to ongoing overcapacity in the battery sector, with average utilization rates at Chinese battery plants falling below 50 per cent.

Despite these near-term challenges, long-term growth for battery metals remains strong. Rising trade tensions and tariffs are also reshaping the EV market, making it harder for automakers to produce and sell affordable models.

Cost, technology and charging trends

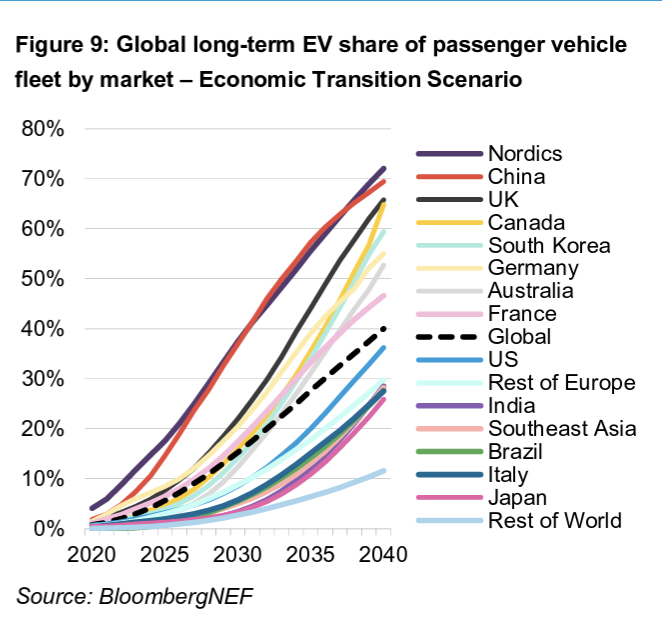

In contrast to the U.S., BloombergNEF’s outlook for Canada’s EV adoption shows the country hitting a hockey stick curve between 2026 and 2040.

Canada’s rate of adoption in the next five years, according to BloombergNEF, will exceed the global benchmark, the U.S. and Europe.

Meanwhile, China is projected to continue to lead the global EV market, maintaining a competitive advantage across manufacturing, pricing and technology.

China produced 69 per cent of all EVs sold worldwide in 2024 and accounts for almost two thirds of global sales. Europe accounts for 17 per cent and the U.S. just seven per cent.

Prices are falling fastest in China due to intense local competition, while global battery pack costs have dropped below US$100 per kilowatt-hour (though they remain higher in Europe and North America).

Solid-state batteries have begun limited commercialization, with BloombergNEF projecting they could make up 10 per cent of EV demand by 2035.

EV charging infrastructure is also improving, with faster networks and shorter charging times. However, rising public charging prices, especially in Europe and the U.S., are beginning to make EV refuelling more expensive than gasoline in some areas.

According to the report, these costs may discourage some consumers from making the switch to EVs and will likely play a growing role in adoption decisions over time.

BloombergNEF’s report may be found here.