Quebec was the only province to post a gain in Q1 and now leads all provinces in ZEV market share (at 25 per cent) and ZEV volume

New data from S&P show a quarter-over-quarter ZEV registrations drop in Q1 2024. Image: Electric Autonomy

Quebec was the only province to post a gain in Q1 and now leads all provinces in ZEV market share (at 25 per cent) and ZEV volume

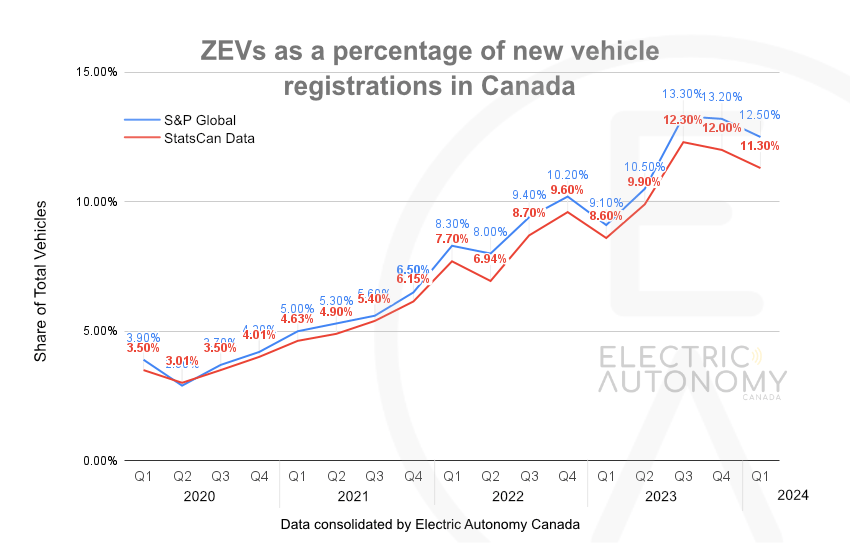

Canadian new light-duty vehicle registrations data from S&P Mobility Canada show a quarter-over-quarter decline in market share for zero emission vehicles (ZEV) in the first three months of 2024.

S&P Mobility reports that ZEV registrations claimed 12.5 per cent of the Canadian market in Q1, down from 13.2 per cent in the fourth quarter of 2023.

The decline was entirely accounted for in the battery electric vehicle segment (BEV), which dropped to 9.2 per cent in Q1 from 10 per cent in Q4. Plug-in hybrid vehicles (PHEV), meanwhile, saw a slight increase to 3.3 per cent in Q1 from 3.2 per cent in Q4.

These results echo the same trend revealed last week in quarterly registrations data published by Statistics Canada, which showed a slip to 11.3 per cent in Q1 from 12 per cent in Q4.

At a provincial level, S&P Global’s data, like StatsCan’s, show Quebec bucking the downward trend, with its ZEV market share reaching 25 per cent in Q1, up from 24 per cent in Q4. British Columbia, meanwhile, saw its ZEV market share fall to 21.9 per cent from 24.3.

As a result, Quebec pulled ahead of B.C. to take top spot among the provinces for the first time in S&P Global’s tally.

On a volume basis, Quebec accounted for almost half of all ZEVs sold in Canada, at 48.7 per cent of the Q1 national total.

(Note: S&P Global Mobility, like Statistics Canada, classifies BEVs and PHEVs as “zero-emission vehicles.” The grouping does not reflect Electric Autonomy‘s view, which considers only non-combustion engine vehicles to be zero-emission. However, where statistics in this report refer to ZEVs, we have adhered to the S&P Global definition for consistency.)

Near-term trend uncertain

S&P Global’s data still tell a positive story on a year-over-year basis, with ZEV market share increasing by more than three per cent since Q1 2023, when ZEVs had a 9.2 per cent share. On a volume basis, Q1 2024 saw 55 per cent more ZEV registrations than in Q1 2023.

What these contrasting annual and quarterly data sets suggest about the trend going forward in 2024, at least, isn’t entirely clear.

The Q1 2024 quarterly decline marks the second straight quarter in which Canada’s overall ZEV market share has fallen after peaking at 13.4 per cent in Q3 2023, based on S&P Global’s figures. The timing of this pullback aligns with the start of the broader overall retrenchment experienced in the global EV sector in the second half of 2023.

Whether the recent decline is just a short-term blip or reflects the start of bigger uphill battle for ZEV market share growth remains to be seen.

In its quarterly report, S&P Global attributes the current “cooling off” to a range of factors, “including market saturation, consumer [sic] waiting for new models, or economic factors that might have influenced purchasing decisions.”

Other provinces and cities

In the quarter, ZEV market share declined in all other provinces and territories, except Nunavut, according to S&P Global. Among the top three provinces and territories after Quebec and B.C., Yukon came in at 10.6 per cent (down from 14.6 in Q4), Prince Edward Island was at 7.1 per cent (down from 8.1) and Ontario was at 7 per cent (down from 8.6).

S&P Global also breaks out registrations data for the country’s three largest metropolitan areas. According to that information, Montreal led in Q1 with a 28.1 per cent ZEV market share, followed by Vancouver at 25.7. Toronto was a distant third at just 8.3 per cent.